Borrow Money Now Without Getting Trapped: Smarter, Faster, Safer Access to Emergency Funds

If you’re searching for ways to borrow money now, chances are urgency is your reality—not a preference. Bills won’t wait, rent is due, and life keeps moving whether your bank account cooperates or not. What you need is clarity, not confusion. And certainly not another dead-end application or sky-high interest rate.

Instead of falling into the usual traps, there are sharp, efficient, and often overlooked strategies that offer immediate funding without sacrificing your financial future. This guide is your no-nonsense pathway to fast, responsible borrowing with a level of control that typical advice doesn’t offer.

When Time Is Tight, Why Most Borrowing Paths Work Against You

Life doesn’t pause for overdrafts, late notices, or surprise expenses. But traditional loans? They still move at a snail’s pace.

Waiting days for approvals, faxing documents, or sitting through lengthy underwriting processes can feel like a cruel joke when what you really need is money today, not a week from now.

It’s easy to reach for fast-cash options like payday lenders or high-interest credit cards—but these can lead to a cascade of repayment issues, fees, and long-term stress. What’s rarely explained is how to bypass these methods while still securing funds in hours—not days.

The Smarter Route to Borrow Money Now

Rapid-Access Lending That Puts You in Control

To borrow money now and getting the funds fast doesn’t require compromise if you know where to look. Technology has quietly transformed how people access emergency financing, offering immediate transfers and flexible repayment.

Real-Time Platforms That Prioritize Speed and Fairness

-

Cash advance apps: Services like Earnin, Brigit, and Dave offer instant transfers based on your earned wages—with no traditional loan application and often no interest.

-

Online lenders with instant underwriting: Fintech lenders such as Upstart, Avant, and SoFi use algorithms that assess more than credit scores, allowing fast approvals with transparent terms.

-

Credit union e-loans: Many local institutions offer same-day personal loans to members with automated processing—often with more lenient requirements than banks.

These aren’t risky shortcuts—they’re smart pivots that utilize financial tools most people never even hear about until it’s too late.

Lesser-Known Borrowing Sources That Fly Under the Radar

H3: Income-Based Lending You May Already Qualify For

You don’t need a 700+ credit score or collateral to unlock funds quickly. These alternatives are often hiding in plain sight:

-

Earned wage access (EWA): Through platforms like DailyPay and Payactiv, employees can borrow against hours already worked, without interest or credit checks.

-

Pay-over-time platforms: Services like Klarna and Afterpay offer point-of-sale borrowing for essential purchases—without traditional loans or credit pulls.

-

Community development financial institutions (CDFIs): These mission-driven lenders exist to serve people with limited access to traditional financing—often providing low-interest emergency loans within 24 hours.

Each of these approaches is built for immediacy, with mechanisms that emphasize access over bureaucracy.

How to Optimize Your Chances of Same-Day Approval

Fast funding doesn’t mean guaranteed approval—unless you know how to tip the odds in your favor.

Application Tactics That Streamline the Process

-

Link a checking account with at least three months of transaction history.

-

Verify consistent income, whether from a job, gig work, or benefits.

-

Minimize current outstanding debt where possible—even $200 extra room on a credit line can change your approval status.

-

Use pre-qualification tools before applying to protect your credit.

These small preps can cut processing time in half and significantly boost approval rates.

FAQs About Borrowing Money Instantly

What is the fastest way to borrow money?

Cash advance apps and online fintech lenders are the fastest routes, often depositing funds within minutes if your account is already verified.

Can I borrow money now with no job?

Yes, as long as you have proof of income—this can include government benefits, freelance payments, or gig economy earnings.

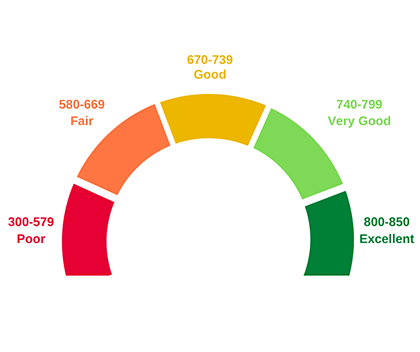

What’s the minimum credit score required?

Many platforms don’t use traditional credit scores. Those that do often accept scores as low as 550 if other factors (like income and banking history) are favorable.

Avoid the Most Common Pitfalls of Fast Borrowing

H3: The Hidden Dangers You Should Flag Immediately

Fast funding often comes with fine print. Watch out for:

-

Double-dipping fees: Some lenders charge both a service fee and a high APR.

-

Balloon payments: Repayment plans that look small up front may stack at the end of your term.

-

Aggressive collections: Read the service agreement’s repayment policy carefully before agreeing to anything.

Quick doesn’t have to mean careless. Due diligence takes just minutes but can save you months of stress.

Turn Short-Term Loans Into Long-Term Stability

Using Emergency Funds as a Strategic Move

Getting access to funds immediately doesn’t have to mean you’re off-track—it can actually be a turning point.

Use these funds to:

-

Prevent overdrafts and avoid NSF fees that wreck your financial standing.

-

Cover essential bills to preserve utilities, housing, or credit history.

-

Bridge a transition period—like between gigs or job shifts—without draining savings.

By thinking beyond the cash and focusing on what the money protects, you change the narrative from crisis to control.

Fast Doesn’t Mean Reckless—Borrow Smart Starting Today

Whether you need $50 or $5,000, the decision to borrow money now doesn’t have to come with risk or regret. By leveraging modern platforms, understanding your leverage points, and selecting the right strategy based on your unique circumstances, you can secure emergency funding while laying a foundation for better financial health.

Final Thought: Your Next Move Is Your Power Move

Now that you know what’s possible, the next step is action. Forget one-size-fits-all advice—this is about choosing the smartest option that gets money into your hands fast without compromising your future.

Explore your top options now. Compare, apply, and access funds on your terms. With the right tools and a clear plan, today’s urgency becomes tomorrow’s opportunity.